.

The Big Dustup Index Fund is a strategy for investing in gold and oil that minimizes downside risk due to economic swings. It is long 2x gold and 1x oil, with a hedge consisting of short 3x US large caps and short 3x world developed markets. It is designed to hold steady regardless of world stock market swings, and only gain when gold and oil go up in comparison to the world stock market.The Big Dustup Index Fund gained 2.7 percent today, which is not bad for a crazy trading day.

I had increased the DPK position on Wednesday since the short hedge (of which DPK is a part) was obviously not big enough during the oil sell-off of Tuesday and Wednesday. This was proved out very well on Thursday when oil again fell, and world markets nearly crashed. DPK's one-day increase was over 12 percent, nicely offsetting the drop in oil.

The short position is probably a little large now -- which would be risky but not disastrous in the event of a market recovery. I attempted to reduce the DPK position late in the day on Thursday, but could not get an order in due to website overloading. If we do have a "bad" stock market day on Friday, the BDUIF should do well.

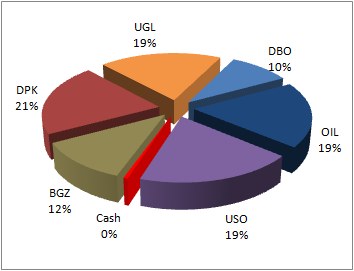

Here are the present BDUIF holdings:

And here is what it looks like with the effects of 2x and 3x leverage explicitly shown:

The performance of the BDUIF since its inception is shown below, compared with the ratios of both gold and oil to the overall Dow Jones Industrial Average. Remember that the idea is to hold steady in normal markets, and gain if there is a war, disaster, or severe economic problems. This risk mitigation comes at the cost of potential gains in normal markets.

The BDUIF attempts to follow the average of the gold/DJIA ratio and the oil/DJIA ratio. This average is the light blue line. "WTI Cushing" is West Texas Intermediate Light Crude, delivered at Cushing Oklahoma. "A-Mark Gold" is the spot price as shown at A-Mark Precious Metals. I transitioned to the A-Mark number since it was readily available, and was more timely than the London PM Spot. It is a good representation of the world spot price late in the US day.

The nexus that occurred on Wednesday is significant. The cumulative performance of gold since fund inception exceeded that of oil for the first time since mid February.

The fact that I had to add to the hedge position shows that oil dropped more in relationship to the stock market than had been anticipated. I believe this is because many of the oil bulls who have been buying oil and oil futures waiting for an event to occur -- even in the face of huge inventories -- gave up when the price started falling. This would indicate that a) the price was artificially high, and b) it dropped lower than it should have (so is now artificially low).

It will be interesting to see which way things go on Friday, but the BDUIF is fairly well positioned regardless.

I may sell some of the DPK Friday.

.

No comments:

Post a Comment